Money Network App Upgrade

Background

First Data’s Money Network is a payroll provider used by thousands of companies, from small businesses to global enterprises, including Walmart, McDonald’s and Dollar General. The First Data Innovation Lab was challenged with broadening the app’s value, already appreciated by employers, for their employees as well.

As a UX Partner at Spring Studio, a boutique user experience agency, I led the research and design efforts to introduce personal finance management (PFM) features to the Money Network app.

Goals

Explore potential solutions to help employees better manage their money via their payroll app, often used as a primary “banking” account.

Translate high-potential solutions into executable feature designs.

Approach

Utilized Design Thinking methodologies, the preferred approach of First Data’s Innovation Lab

Two rounds of generative interviews with Money Network app users from various companies

3 rapid rounds of interviews and “bank-alongs” using mobile app prototypes

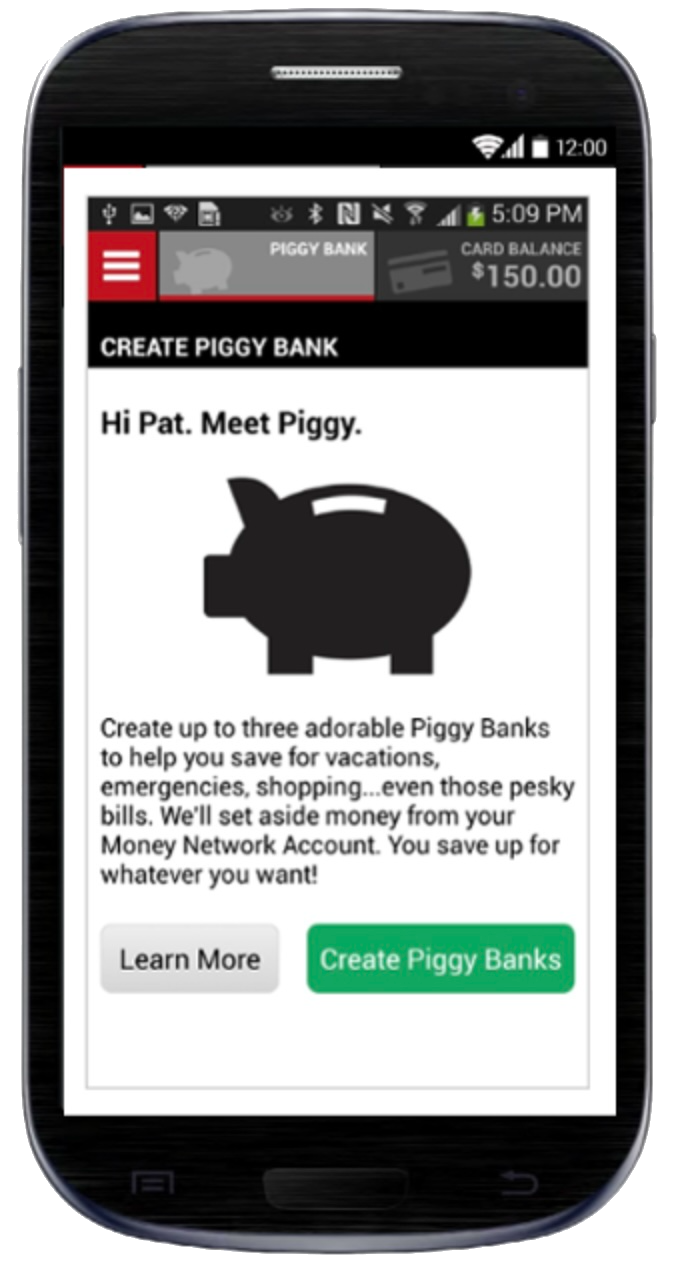

Pre-launch “disaster check” usability research of ‘Piggy Bank” feature.

Insights

Lower-wage workers, especially the “unbanked”, find themselves relying exclusively on the Money Network app as a personal finance management tool.

Personal debt is the norm and most feel pessimistic about their finances. Their debt is a constant, disempowering influence, draining motivation to explore options for better money management.

Almost all participants have had a traumatic experience that, along with their debt, colors their perception of their PFM opportunities. Past savings attempts often fail because of a “broken boiler” type event whose costs set them back financially and emotionally.

Tracking their spending and, where possible, their savings is extremely stressful and often avoided. Many feel not only stressed about just getting by but also ashamed of their perceived inability to manage their money.

A friendly, understanding face to a PFM feature injects humor and empathy into budget tracking and savings, encouraging users to consider using these tools.

It is empowering to save for goals that delight as well as protect, with Vacations and Rainy Day as top categories selected in the app prototypes.

Output

Generalized insights into the attitudes, emotions and behaviors of lower-wage employees in regard to tracking their budgets and saving for goals. These insights informed not only the Money Network app but also marketing messaging and collateral.

Over a dozen feature concepts to inform the payroll services’s roadmap and backlog.

Strategy, design and content for widely-used feature; digital Piggy Banks for setting and saving for goals. Note that I also came up with the name and wrote the in-app copy for this feature.